Exploring the realm of commercial auto policy coverage, this article dives into the common myths that often mislead businesses. By shedding light on these misconceptions, readers can gain a clearer understanding of what their policies truly entail.

Common Myths About Commercial Auto Policy Coverage

There are several misconceptions surrounding commercial auto policy coverage that can lead to confusion among business owners. Let's debunk three common myths and shed light on the reality.

Myth 1: Personal Auto Insurance is Sufficient for Commercial Use

Some business owners believe that their personal auto insurance policy will cover them adequately in case of accidents while using their vehicle for business purposes. However, this is not the case. Personal auto insurance typically excludes coverage for business-related activities such as transporting goods or clients.

Example: If a delivery driver gets into an accident while making a delivery for their employer, their personal auto insurance may not cover the damages or injuries, leaving the business liable for the costs.

Myth 2: All Commercial Auto Policies are the Same

Another common misconception is that all commercial auto insurance policies offer the same coverage options. In reality, policies can vary significantly depending on the insurer, the type of business, and specific needs. It's essential for business owners to carefully review and customize their policy to ensure adequate coverage.

Example: A construction company may require additional coverage for tools and equipment stored in their vehicles, which may not be included in a standard commercial auto policy.

Myth 3: Comprehensive Coverage is Unnecessary for Commercial Vehicles

Some business owners mistakenly believe that comprehensive coverage is unnecessary for their commercial vehicles, especially if they are older or not used frequently. However, comprehensive coverage can protect vehicles from a wide range of risks, including theft, vandalism, and natural disasters.

Example: Even if a company vehicle is not used daily, it can still be at risk of theft or damage while parked at a job site. Comprehensive coverage can provide peace of mind in such situations.

Coverage Limitations

When it comes to commercial auto policies, coverage limitations play a crucial role in determining the extent of protection a business has in case of accidents or incidents involving their vehicles. Understanding these limitations is essential to avoid gaps in coverage that could potentially lead to financial losses.

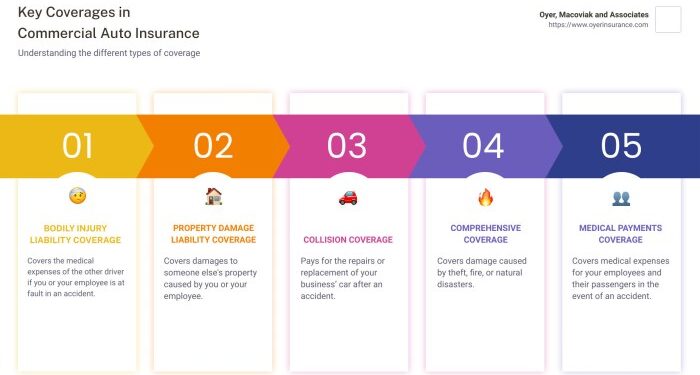

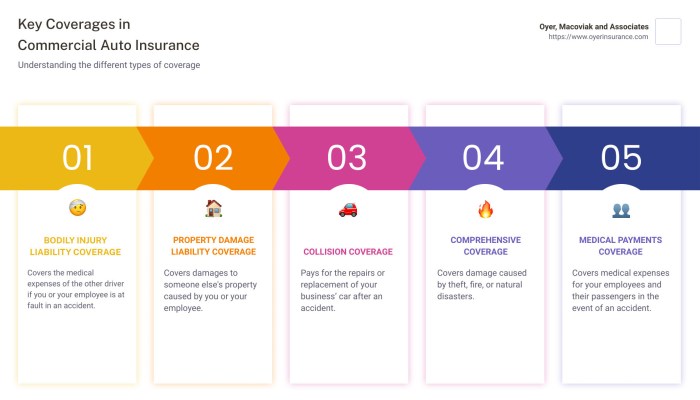

Types of Coverage Limitations

There are several common coverage limitations that businesses should be aware of when purchasing a commercial auto insurance policy. Let's compare and contrast these limitations with the actual policy coverage to highlight their impact.

- Excluded Drivers:Some policies may restrict coverage for drivers who are not listed on the policy. In case of an accident involving an excluded driver, the business may not be protected.

- Vehicle Use Restrictions:Certain policies may limit coverage based on the type of vehicle use, such as for commercial purposes only. Any other use may not be covered.

- Deductibles and Limits:Coverage limitations related to deductibles and policy limits can significantly impact the amount of reimbursement a business receives in case of a claim.

Real-Life Scenarios

Let's consider a scenario where a business owner assumes that their commercial auto policy covers all drivers using the company vehicles. However, in an unfortunate event where an employee not listed on the policy gets into an accident, the coverage limitation for excluded drivers comes into play, leaving the business liable for damages.

Another example could involve a business that fails to disclose the regular use of a vehicle for deliveries, resulting in a claim denial due to coverage limitations on vehicle use restrictions. This oversight can have significant financial repercussions for the business.

Understanding Exclusions

When it comes to commercial auto insurance policies, understanding exclusions is crucial for businesses to avoid unexpected gaps in coverage. Exclusions are specific situations or conditions that are not covered by the policy, and failing to recognize these exclusions can leave a business vulnerable to financial losses.

Typical Exclusions in Commercial Auto Insurance Policies

- Intentional acts: Any accidents or damages caused intentionally by the insured party are typically excluded from coverage.

- Racing or reckless driving: Accidents that occur while the vehicle is engaged in racing activities or reckless driving are often excluded.

- Non-permitted drivers: If an unauthorized driver operates the commercial vehicle and gets into an accident, the policy may not provide coverage.

- Use of vehicle for illegal activities: Any accidents or damages resulting from the use of the vehicle for illegal purposes are usually excluded.

- Wear and tear: Normal wear and tear or mechanical breakdown of the vehicle is not covered by commercial auto insurance.

How Businesses Can Mitigate Risks Associated with Exclusions

Businesses can take proactive steps to mitigate risks associated with exclusions in commercial auto insurance policies. One way is to carefully review the policy documents and understand the specific exclusions that apply. Additionally, businesses can implement strict driver policies, conduct regular vehicle maintenance, and ensure all drivers are properly trained and authorized to operate the commercial vehicles.

Policy Add-Ons and Enhancements

When it comes to commercial auto insurance policies, there are various add-ons and enhancements available that can provide additional coverage or benefits to businesses. It is important to customize policies with relevant add-ons based on specific business needs.

Types of Add-Ons and Enhancements

- Gap coverage: Provides coverage for the difference between the actual cash value of a vehicle and the amount still owed on a lease or loan.

- Rental reimbursement: Covers the cost of a rental vehicle while a commercial vehicle is being repaired after an accident.

- Towing and roadside assistance: Offers services like towing, tire changes, and fuel delivery in case of a breakdown.

- Hired auto coverage: Extends coverage to vehicles rented or borrowed for business purposes.

- Non-owned auto coverage: Protects the business when employees use their personal vehicles for work-related tasks.

Final Thoughts

In conclusion, it's crucial for businesses to separate fact from fiction when it comes to commercial auto policy coverage. By dispelling these myths and embracing accurate information, companies can make informed decisions that protect their assets and operations in the long run.

FAQ Summary

What is a common myth about commercial auto policy coverage?

One common myth is that personal auto insurance provides sufficient coverage for commercial vehicles, which is not true. Commercial vehicles require a separate policy.

How do coverage limitations impact commercial auto policies?

Coverage limitations can result in gaps in protection, leaving businesses vulnerable to financial loss in case of accidents or other incidents. It's essential to understand these limitations and consider additional coverage options.

What are typical exclusions in commercial auto insurance?

Typical exclusions may include coverage for employees using personal vehicles for work purposes, intentional acts, and driving under the influence. Understanding these exclusions is crucial for businesses to avoid surprises during claims.

What are some common add-ons and enhancements for commercial auto policies?

Common add-ons include coverage for hired or non-owned vehicles, roadside assistance, and increased liability limits. These enhancements can provide extra protection tailored to the specific needs of a business.